Efficiently manage your Inherited IRA’s Required 10-Year Distribution

In this post we’ll discuss how to avoid a large tax crunch and efficiently manage your Inherited IRA distributions if you are subject to the 10-Year rule.

If you inherited a tax-deferred account (Traditional IRA, 401(k), 403(b)), the rules to maintaining that inheritance used to be pretty simple. Prior to 2020, you would just have to take an annual Required Minimum Distribution (RMD) from that account and would be able to “stretch” that account over your lifetime.

In 2020, Congress passed the SECURE Act, which changed the rules regarding Inherited IRAs. This only applies to inherited accounts where the decedent passed on 1/1/2020 or later. If you inherited your account prior to then, the old “stretch” rules continue to apply to you. The SECURE Act split beneficiaries into two categories:

Eligible Designated Beneficiaries

Non-Eligible Designated Beneficiaries

An Eligible Designated Beneficiary a beneficiary who is:

The deceased account holder’s spouse

A minor child

A disabled individual

A chronically ill individual

A person not more than 10 years younger than the deceased account holder

If you’re not one of the above, then you are more than likely a Non-Eligible Designated Beneficiary.

This distinction is important, because it determines how your Inherited IRA will be treated from a required distribution standpoint.

Eligible Designated Beneficiaries get to “stretch” their RMDs over their lifetime (or until they reach the age of majority if they’re a minor child). Basically, same as the old rule.

Non-Eligible Designated Beneficiaries must deplete the entirety of their account by the end of the 10th year following the account owner’s passing (i.e., if the account owner passed in 2024, the Inherited IRA must be entirely depleted by the end of 2034).

Additionally, if you are a Non-Eligible Designated Beneficiary and the decedent was already taking RMDs, then you too must take annual RMDs throughout those 10 years.

This blog is going to focus on Non-Eligible Designated Beneficiaries. These are the beneficiaries who are subject to the 10-Year rule.

If you inherit a pre-tax IRA and are subject to the 10-Year rule, you may be thinking: “This sounds pretty simple. I’ll just let the funds grow in the Inherited IRA for the next nine years, then withdraw everything during the 10th year.” While that may keep you compliant with the IRS (assuming you don’t have any RMD obligations with the account), it likely is not the best way to go about your inheritance distribution.

Approaching your Inherited IRA distributions in that manner may leave with you a large “tax crunch” during that 10th year (depending on the size of your inheritance and the investment growth it realizes). Instead, it may be more efficient from a tax standpoint to spread those distributions out gradually throughout the 10-Year period.

Here is an example to help illustrate:

This is a hypothetical / illustrative example. Your own tax situation may differ from this. The hypothetical performance does not represent actual performance, was not achieved by any investor, and actual results may vary substantially.

Let’s take someone who inherits a $250,000 IRA in 2024 and is a Non-Eligible Designated Beneficiary. For simplicity purposes, we’ll assume they are not subject to annual RMDs, but they are subject to the 10-Year rule. This means that they technically don’t have to do anything with the IRA until 2034, at which point they must make sure the entire account is distributed before year end.

We’ll say this individual earns $100,000 / year (increasing annually with inflation) and files single. We’ll also assume they live in Pennsylvania for state tax purposes. Lastly, we’ll assume their investments average a 7.0% annual return.

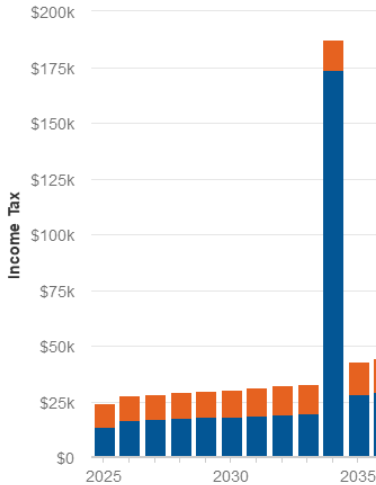

If this individual decides to wait until 2034 to deplete their entire account, their tax situation over the next 10 years would project to be the following:

(The blue lines represent Federal income taxes, while the red lines represent Social Security tax, Medicare tax, and State income tax.)

This individual’s Federal income taxes and State income taxes would be projected to be:

**For illustrative purposes, we assume the tax laws do not sunset in 2026**

They would be looking at a tax bill of $175,000 in that 10th year! When they’re usually around the $20,000 range.

The above charts really help to illustrate that “tax crunch” referenced earlier. This individual would be deferring investment related taxes on the account for 9 years, but in 2034 they’d see a significant increase in income taxes due.

Remember, this IRA is growing at an assumed rate of 7.0% per year. At the end of the 10th year, this $250,000 IRA would now be worth more than $487,000. That entire $487,000 needs to be withdrawn in 2034 and is fully taxable, which now pushes this person from their usual 22% marginal bracket all the way into the 35% marginal bracket.

Because of this tax crunch, I generally recommend to my clients a gradual drawdown of the Inherited IRA over the 10-year period, even if they’re not subject to RMDs. Certain circumstances may call for a more customized approach (i.e., an abnormally high-income year, an abnormally low-income year, coming up on retirement, etc).

But again, for simplicity purposes, we’ll assume this individual’s tax picture remains consistent throughout the years. Let’s take a look at this same example, but this time the beneficiary depletes the Inherited IRA gradually. We’ll assume they take their IRA distributions every year and move them into an Individual Account, where they continue to invest their inheritance and earn that 7.0% average annual return.

A drawdown schedule I commonly implement when the tax outlook remains consistent over the 10-year period may be an installment schedule of:

It’s important to have a drawdown schedule that aligns with your own financial picture and tax landscape. But this is a way to gradually and more evenly draw down an account over 10 years.

This would mean that in Year 1, this individual is taking a $25,000 distribution (10% of $250,000). We of course want to keep that money invested, so they can simply move that $25,000 into a taxable account for themselves and reinvest the distribution.

After Year 1 and considering the $25,000 distribution and the 7% growth, the Inherited IRA is worth $240,750. Following the distribution schedule, in Year 2 this individual would distribute 11% of the account value, or $26,483.

Remember, these distributions are fully taxable. But by doing so in smaller chunks, these distributions are being taxed in the 22% and 24% brackets for this individual, compared to the 22%, 24%, 32%, and 35% brackets in the first example.

If the individual applies this drawdown strategy to their Inherited IRA, their tax situation over the next 10 years would project to be:

Very different from taking everything out in Year 10. As you can see, we now don’t have that massive tax hit in 2034. It’s much more gradual. Their Federal and State Income taxes would project to be the following:

To compare the total taxes paid in the two scenarios:

Delay entire distribution until the 10th Year:

$341,273 in total Federal and State income taxes paid over 10 years

Gradually draw down the Inherited IRA over the 10 years:

$277,046 in total Federal and State income taxes paid over 10 years

That’s a difference of $64,227 in taxes paid over the 10 years for this individual!

This is a hypothetical example. It’s important to understand your own tax situation when considering the drawdown of your Inherited IRA. There may be good reason to delay your distributions. If you’re coming up on retirement, it’s likely your income will reduce after you retire. In that situation, it may make sense to hold off on distributions until you retire and are in a lower tax bracket.

Everyone’s situation is different, but if you were planning on simply delaying everything till the 10th year, it’s important to realize you may be setting yourself up for a large and unnecessary tax bill that 10th year.

The person who left you the inheritance would certainly rather you enjoy the money instead of Uncle Sam. And as illustrated, being mindful of the taxes that come with these accounts and the plan you have to deplete your Inherited IRA over the 10 years can save you a significant amount of taxes owed.

Distributions from pre-tax retirement accounts, even when they’re inherited, are taxable as ordinary income to you. So, you want to be thoughtful in the way you approach these distributions. When intentionally realizing income, working with an accountant or a financial planner may be helpful. They can help guide your drawdown strategy based on your own unique tax situation and help you keep more of your inheritance.

I hope this helps provide insight when considering your own strategy. If you’ve inherited an IRA and are looking for assistance with your own drawdown strategy, please feel free to reach out or schedule an appointment. You’re able to do so right on the homepage.

Thank you as always and have a great day.

Best regards,

Drew Schaffer, CFP®

Ellis Investment Partners, LLC (EIP) is an investment advisor in Berwyn, PA. EIP is registered with the Securities and Exchange Commission (SEC). Registration of an Investment Adviser does not imply any specific level of skill or training and does not constitute an endorsement of the firm by the commission. EIP only transacts business in states in which it is properly registered or is excluded from registration. A copy EIP’s current written disclosure brochure filed with the SEC which discusses among other things, EIP’s business practices, services and fees, is available through the SEC’s website at: www.adviserinfo.sec.gov The views expressed represent the opinion of Ellis Investment Partners, LLC (EIP) which are subject to change and are not intended as a forecast or guarantee of future results. Stated information is derived from proprietary and nonproprietary sources which have not been independently verified for accuracy or completeness. While EIP believes the information to be accurate and reliable, we do not claim or have responsibility for its completeness, accuracy, or reliability. Statements of future expectations, estimate, projections, and other forwardlooking statements are based on available information and management’s view as of the time of these statements. Accordingly, such statements are inherently speculative as they are based on assumptions which may involve known and unknown risks and uncertainties. Actual results, performance or events may differ materially from those expressed or implied in such statements. Past performance of various investment strategies, sectors, vehicles and indices are not indicative of future results. There is no guarantee that the investment objective will be attained. Results may vary. There is no guarantee that risk can be managed successfully. Investments in securities involve risk, including the possibility for loss of principal. EIP does not provide tax or legal advice. You should seek counsel from your tax or legal adviser for your specific situation. Drew Schaffer is an independent Investment Advisor Representative of Ellis Investment Partners, LLC (EIP). Financial Planning and Investment Advisory Services are offered solely by EIP, a registered Investment Advisor, 920 Cassatt Road, 200 Berwyn Park, Suite 115, Berwyn, PA 19312, 484-320-6300.